Daily Mail: Rules on inheriting a 401(k) have been revamped -

everything you need to know and how to avoid a shock bill

For an article about what Americans need to know when they inherit a 401(k) or IRA, the London-based Daily Mail interviewed Peter J. Gallagher, Managing Director, Unified Retirement Planning Group in Briarcliff Manor, NY. Peter discussed new IRS rules and the importance of understanding tax ramifications, and emphasized the need for professional financial guidance. Click here.

Daily Mail: Hidden stock market clues that can predict election results –

as experts reveal who they think will win in 2024

The London-based Daily Mail interviewed Peter J. Gallagher, Managing Director, Unified Retirement Planning Group in Briarcliff Manor, NY, about annual financial industry research claiming the performance of the S&P 500 during an election year can predict if the incumbent president wins. Peter did not engage in predictions and suggested other criteria, noting how our clients are focused on inflation and cost of living issues. Click here.

Daily Mail: As the S&P 500 and Dow climb to record highs - here's what it means for your 401(k)

The London-based Daily Mail interviewed Peter J. Gallagher, Managing Director, Unified Retirement Planning Group in Briarcliff Manor, NY, about the record highs of U.S. stock market indices as the new year began and what the rally meant for an investor's 401(k). Peter discussed the importance of having a plan and focusing on long-term investment goals. Click here.

San Francisco Chronicle: What does stock market’s record high mean for your 401(k)?

Peter J. Gallagher, Managing Director, Unified Retirement Planning Group in Briarcliff, NY, was interviewed by a San Francisco Chronicle reporter in mid-December about his thoughts on what the stock market’s recent record highs meant for an investor’s 401(k). Peter discussed the importance of having a plan, which includes investment diversification, and focusing on the long term, rather than periodic market plunges. Click here.

Five Questions to Ask Your Current Advisor

How transparent is your current advisor concerning fees and investment recommendations? Here are five questions you can ask to become fully informed. To learn more, click here.

Money.com: Health Care Expenses in Retirement Average $67,000 –

Even With Medicare Coverage

Peter J. Gallagher, Managing Director, Unified Retirement Planning Group in Briarcliff Manor, NY, was quoted in a Money.com article on September 29, 2022 on health care expenses for retirees. Peter discussed the importance of having long-term care insurance. Click here.

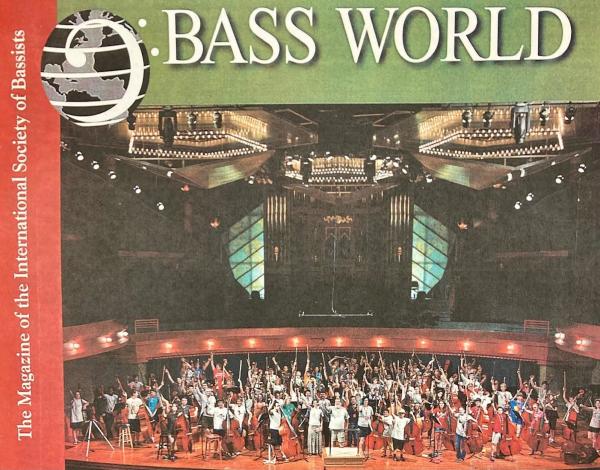

International Society of Bassists Magazine:

“How A Major Career Change Still Brings Music to My Ears”

(June – September 2022)

In an article in Bass World, the magazine of the International Society of Bassists, Peter J. Gallagher, Managing Director, URPG, reflects on his time as a classically trained string bassist before switching careers 25+ years ago to venture into retirement planning. He emphasizes that the similarities of both professions have to do with discipline, collaboration and performance at a high level. URPG’s partnership with Commonwealth is also highlighted. Click here.

Figures contained in article are as of February 24, 2022.

Wall Street Journal: What Fed Rate Increases Mean for Your Financial Plans

How to time your financial decisions as interest rates rise

Peter J. Gallagher, Managing Director, Unified Retirement Planning Group in Briarcliff Manor, NY, was quoted in a WSJ article in advance of the June 15, 2022 Fed Meeting. Peter advised that good financial decisions in the face of imminent interest rate increases include paying down debt and know the risks regarding adjustable-rate mortgages. Click here.

New York Times: When Your Hand Is Forced In a Bearlike Market

We welcomed the opportunity to be interviewed for the "Retiring" column in the Times' Sunday Business Section, June 12, 2022. Peter J. Gallagher, Managing Director, Unified Retirement Planning Group in Briarcliff Manor, NY, provided perspective about taking IRS-required minimum distributions at age 72 amid market turbulence. Click here.

Ossining Gazette: URPG Provides Community Funds

to Expand Local Library’s Financial Education Collections

_1653503767.jpg&height=253&width=450)

In celebration of Financial Literacy Month and National Library Week 2022, and in support of getting one’s financial health in shape, United Retirement Planning Group provided community funds to the Friends of the Briarcliff Manor Public Library to expand financial education collections for both children and adults. Meet the BMPL team who collaborated with URPG.

Ossining Gazette: Croton Caring Event Sponsored by URPG

URPG was delighted to sponsor Croton Caring's Spring event for seniors on Saturday, March 26, 2022. We shared our mission as a retirement planning firm and as a values-based organization with a focus on community giving. The Ossining Gazette ran a front-page story

URPG Virtual Community Retirement Conversations Series:

Navigating Money Matters Through Difficult Times

Peter J. Gallagher, Managing Director, URPG, and Patricia G. Micek, Esq., an estate planning attorney and elder law expert, discuss what women need to know in the event of a life change like becoming a widow or getting divorced.

URPG Virtual Community Retirement Conversations Series: A Checklist

With the new year upon us, Peter J. Gallagher, Founder and Managing Director, Unified Retirement Planning Group, recently discussed retirement planning, including how to get started as well as what you should know to effectively maintain your existing plan. Other topics included today’s retirement landscape, mistakes to avoid, and positive habits to acquire.